Ethereum could begin a rally if trading volume increases amid bullish expectations

- Ethereum's price often takes a downward shift after FTX and Alameda sell ETH.

- Traders expect a price rise in ETH following reduced long liquidations and normalizing risk reversals.

- Ethereum needs increased trading volume to break past key resistance levels.

Ethereum (ETH) has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Also read: Ethereum shows signs of a potential rally as suspected Justin Sun wallet buys heavily

Daily digest market movers: FTX sale, normalized risk reversals, active wallet increase

Ethereum's latest price movement is hinting at a potential rally. Here are key market movers driving the second-largest cryptocurrency:

- Since March 1, FTX and Alameda Research have deposited 20,350 ETH at strategic points right before a price dip, according to Spot On Chain. This insight comes as FTX and Alameda deposited 4,500 ETH worth $14.4 million to Binance and Coinbase at $3,207 on Tuesday. Investors may need to observe if ETH will take a downturn as in previous times. Other investors may be using FTX's move as a sell signal, hence the consistent price drop after the firm's ETH sales.

- With ETH's recent price recovery, long traders are looking to gain control as long liquidations have slowed down significantly on Tuesday compared to the past two weeks, according to data from Coinglass. Short liquidations are increasing, with over $13.45 million liquidated, while long liquidations sit at $7.4 million in the past 24 hours.

ETH risk reversals have also normalized above -4%, from -12% one week ago, indicating traders are beginning to expect a price improvement, according to QCP Capital. As a result, "improving speculative sentiment could see short covering and a resumption of leveraged longs," said QCP.

Read more: Ethereum resumes consolidation after brief dip, buyback yield exceeds that of major S&P 500 companies

- Meanwhile, Bankless podcast co-host Ryan Sean Adams pointed out the increasing number of active wallets in the Ethereum ecosystem, which has grown to over 10 million weekly active wallets. He speculated that the Ethereum ecosystem can now increase user growth by 10x to 100 million in this bull run.

- The US Securities & Exchange Commission (SEC) has also delayed its response to Franklin Ethereum ETFs, a series of the Franklin Ethereum Trust. The latest spot Ethereum ETF decision delay follows a series of timeline delays the regulator has given to other applicants.

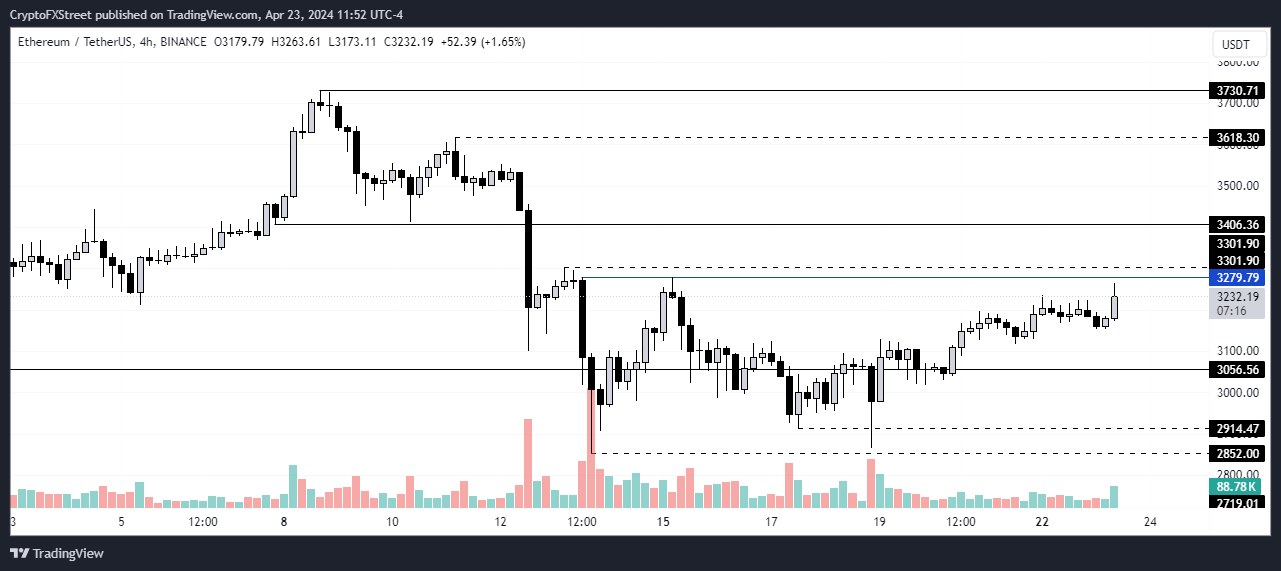

Technical analysis: Ethereum needs increased volume to break past key resistance

Ethereum's recent price movement is teasing that a potential rally is on the horizon as it's attempting to break the upper side of the $2,852 and $3,300 key range. But it must first move past the $3,279 resistance to confirm.

Also read: Ethereum shows firm support at key level as its correlation with US indices increase

However, declining trading volume amid the price increase is a concern. While bulls appear to have taken the wheels again, the reduced trading volume indicates low commitment and uncertainty. ETH could quickly push forward to break past the $3,300 key level if increased volume accompanies the rising bullish sentiment.

ETH/USDT 4-hour chart

Such a move will see ETH filling the liquidity void of April 13 and aiming for the next resistance of $3,406 formed on April 7. This resistance may prove easy to break past if trading volume increases. However, if volume fails to increase, ETH may fall back to the $3,056 support of March 20.

Additionally, with the halving behind us, Bitcoin's dominance over ETH may reduce in the long term, leaving room for the largest altcoin to craft its own path.

Ethereum is trading around $3,232, up 1.3% on the day at the time of writing.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.